November 14, 2023

Supreme Court of California

350 McAllister Street

San Francisco, CA 94102-4797

Re: Legislature of the State of California et al. v. Weber, Case No. S281977

Honorable Chief Justice Guerrero and Honorable Associate Justices:

We, the undersigned duly elected representatives of the California State Legislature, submit this amicus letter to express our strong opposition to the lawsuit, State of California et al. v. Weber, which seeks to remove the Taxpayer Protection and Government Accountability Act (TPA) from the November 2024 ballot.

First and foremost, we must correct the misinformation provided to this Court. While certain legislators took it upon themselves to file this lawsuit, its purpose and content were never approved via legislative action and we do not support this blatantly undemocratic attempt to disenfranchise voters by removing a voter-qualified initiative from the ballot.

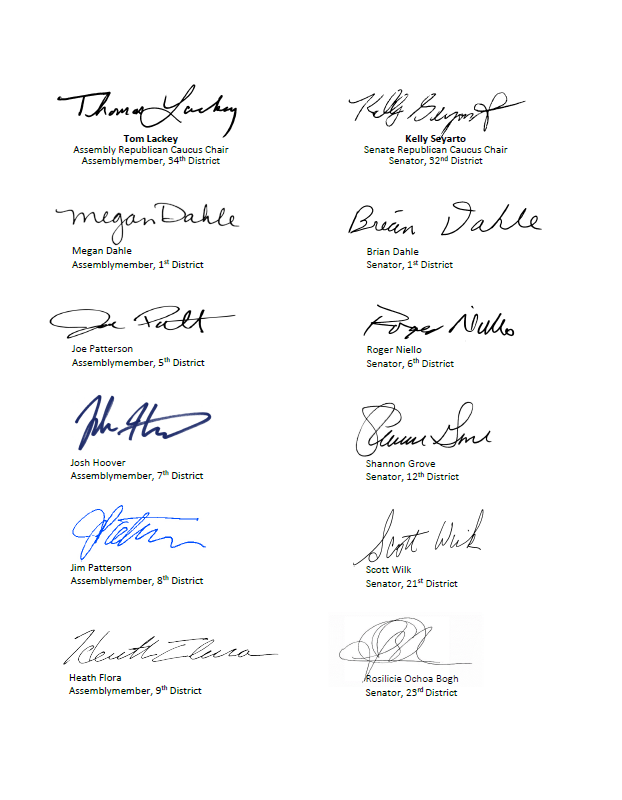

As such, because the Legislature never took a vote to engage in this lawsuit nor does it have any defined processes for making the body party to a lawsuit, we respectfully request the record to reflect that only a select few legislators support it – only those who have actually signed onto the amicus brief.

TPA may present a political threat to certain politicians, but it is nevertheless a valid and duly qualified initiative measure. Petitioners’ justifications for the lawsuit are weak at best, and show the clear intention of their filing. They want this Court not to rule on legal grounds, but on political ones. They are also misleading the Court to believe that the entire Legislature—as a cohesive body—approved this lawsuit. That is false.

TPA is not a constitutional revision; it simply adds to the foundation of taxpayer rights enumerated in Prop. 13, Prop. 62, Prop. 218, and Prop. 26. TPA builds on decades of voter-approved ballot measures seeking to rein in the nearly unchecked power of the Legislature to raise taxes, fees, and the overall cost-of-living. Now more than ever, as the state continues to struggle with the highest-in-the-nation poverty rate, TPA will be an opportunity for voters to once again exert their constitutional right to act as a check and balance through the initiative process.

This Court must not take the extraordinary and near-unprecedented action of removing an eligible ballot measure prior to voters having their say. Petitioners’ brief relies on hypotheticals, supposition, and hyperbole in an attempt to convince this Court to grant pre-election review, which is strongly disfavored. (See Page 9, Preliminary Opposition to Emergency Petition for Writ of Mandate and Request for Immediate Stay, Legislature et al. v Weber (Hiltachk), Case No. S281977). However, their arguments fall flat. Revenues remain historically high, even with the economic slowdown we are currently facing. Moreover, Petitioners essentially argue that the only solution to budget shortfalls is higher taxes, refusing even to consider making adjustments to the state budget. In fact, current budget spending will put the state into debt in just a few short years, regardless of whether TPA is enacted or not. Poor financial planning by Governor Newsom and the Democrats in the Legislature is not a reason to deny voters their constitutional rights.

Requiring voter approval of taxes passed by the Legislature will not interfere with our ability to govern and does not take power away from us. It simply requires us to do what we were elected to do: represent the people of California. If we are truly representing the people, we will come together to create better, more meaningful policies we all can support and will gain support from our constituents. TPA not only encourages better policy, it ensures tax dollars are spent for their designated purpose, thus improving the operations of government. We will be better able to plan and execute budgets knowing what money we have designated for particular purposes, and what money is available for general purposes.

Requiring legislators to vote on fees and other costs proposed by unelected bodies is also not new, nor is it cumbersome; in fact, the Legislature approves fees all the time. Democrats in the Legislature have chosen to move many of the cost-increasing policies to agencies to implement, not because they are better equipped, but because it is politically expedient. Especially in these times, anything increasing

the cost of gas, electricity, goods and services should be under the purview of the Legislature and subject to a democratic vote. Indeed, legislators have purposefully reduced their own roles of oversight and accountability, allowing unelected bureaucrats to instead raise myriad hidden taxes. Again, this is a core function of the Legislature as representatives of our constituents. Voters have no representation on these boards or government agencies and must rely on us as their duly elected representatives to act on their behalf. TPA restores that proper role for the Legislature and does not take it away as Petitioners erroneously contend.

What is clear is that Petitioners do not advance legal arguments against TPA, but instead seek to litigate a mere disagreement about tax policy. Such disputes are not the proper province of our courts.

For these reasons, we respectfully ask you to reject Petitioners’ request for extraordinary pre-election review and allow the voters to execute their constitutional right to vote on TPA next November.

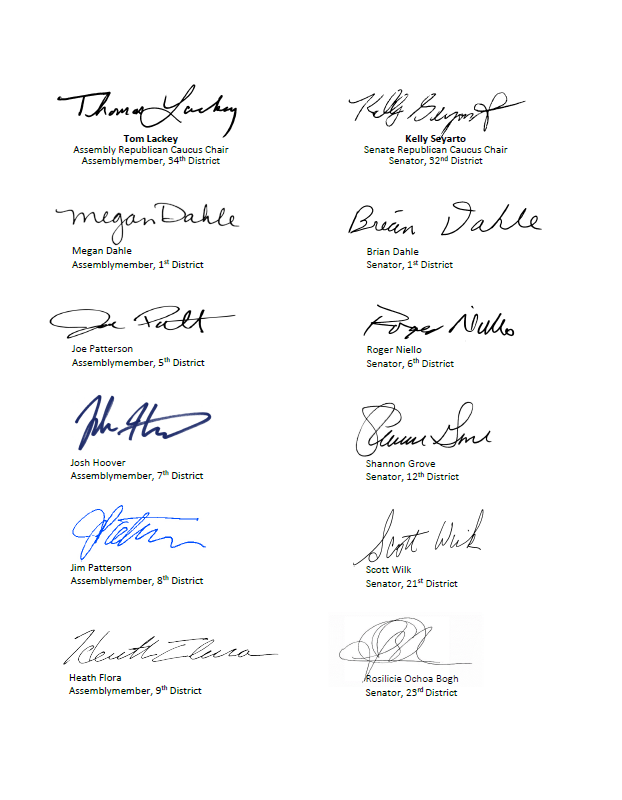

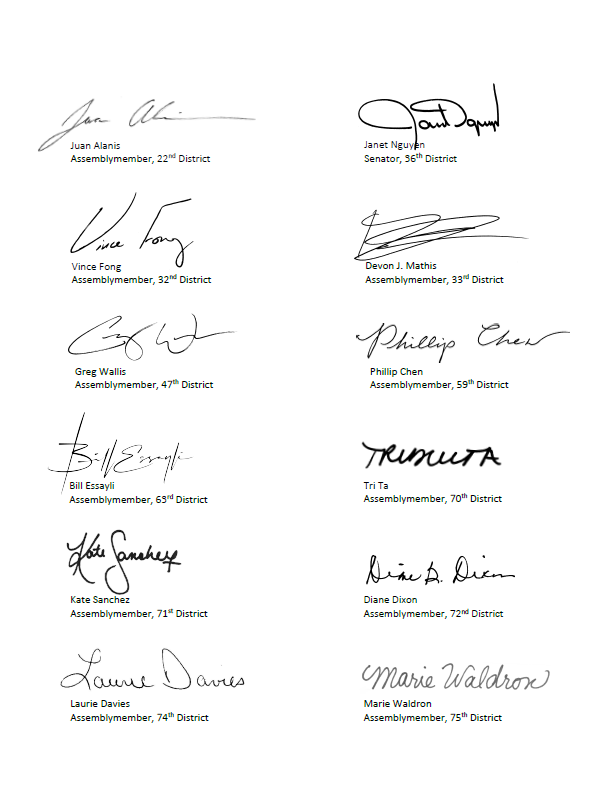

Sincerely,